Designed for Small Business Owners and Bookkeepers

CRA-Compliant Deductions

PayCub automatically calculates federal and provincial tax, CPP, EI, and employer contributions with up-to-date CRA rules. No manual updates, no guesswork — just accurate deductions every time.

Designed for Small Business

Manage payroll for your business with full control. Create paystubs effortlessly, run payroll quickly, and deliver accurate paystubs and reports with ease.

Customizable Paystub Templates

Choose from a variety of paystub layouts and colour themes. Match your brand, keep it professional, and give employees clear, polished stubs every payday.

Employee Portal (Coming Soon)

Soon employees will be able to log in to their own secure portal to view paystubs, tax slips, and payroll history — reducing requests and giving staff instant access to what they need.

AI-Powered Assistant

Ask questions, run payroll tasks, or get help instantly. PayCub’s built-in AI assistant can guide you step-by-step — and works in any language, making payroll more accessible than ever.

AI Help in Any Language

PayCub’s built-in AI assistant can understand and respond in any language, making it easier for diverse teams and clients to get the help they need.

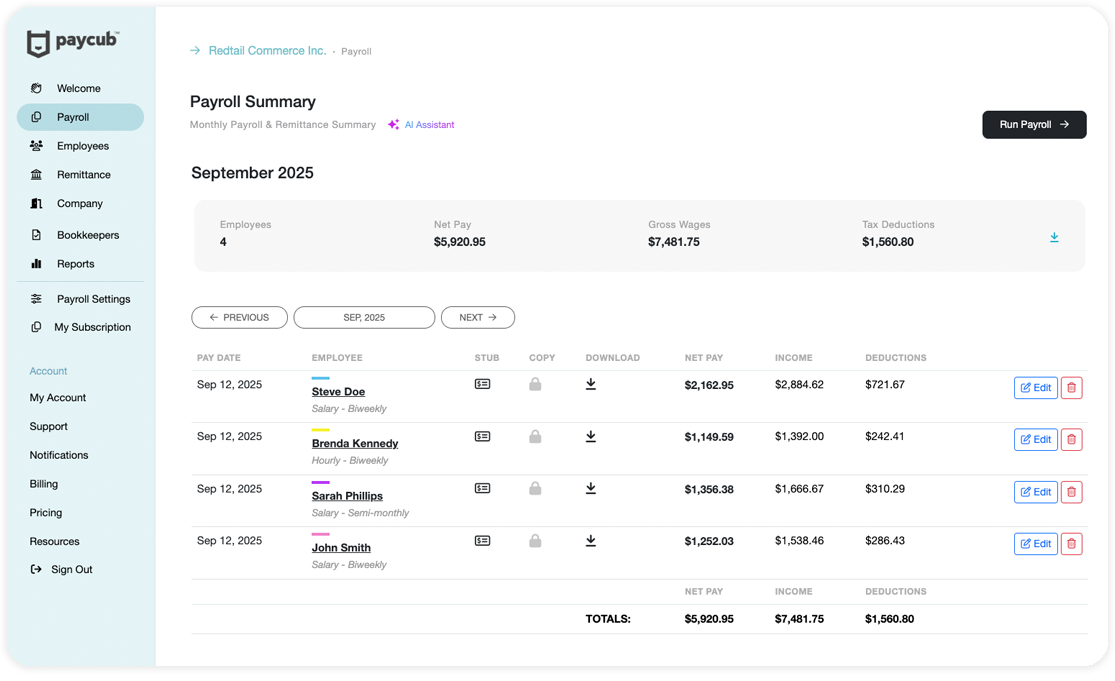

Take Full Control of Your Pay Day

Run payroll in just minutes. Whether you pay employees weekly, biweekly, semi-monthly, or monthly, PayCub makes payday simple and stress-free. Accurate calculations, automatic deductions, and professional paystubs are ready with a few clicks.

The Complete Payroll Solution

-

Stay on top of your obligations with built-in remittance reporting. Generate monthly, quarterly, or yearly reports instantly, giving you everything you need to file with the CRA and keep your business compliant.

-

PayCub brings together speed, accuracy, and compliance — a complete payroll solution designed for Canadian businesses.

Payroll - August 2026

$967

Complete - Sending

-

Regular Pay: $812.00

-

Deductions: $155.00

$10,427.00

Payroll Year-to-date

Payroll Made Easy for Bookkeepers

-

Manage multiple client companies from a single dashboard. Switch between payroll files instantly without logging in and out.

-

Run payroll in minutes — whether it’s weekly, biweekly, semi-monthly, or monthly. Quick commands make pay runs smooth and efficient.

-

Generate CRA-ready remittance reports, year-end T4s, and summaries with just a few clicks. Accuracy built in, no extra spreadsheets required.

-

Run Your Own Payroll

With PayCub, small businesses can run payroll entirely on their own — no outside provider needed. Set up employees, choose your pay schedule, and generate professional paystubs in just a few clicks.

-

Professional Pay Stubs

Generate clean, professional pay stubs your employees can trust. Choose from multiple templates and colour themes to match your brand. Simple, accurate, and ready to share digitally or print in seconds.

-

Remmitance Reports

Your payroll data is stored securely on Canadian servers with modern encryption. Access is restricted ensuring your business information stays private and compliant.

Stories From Our Customers

PayCub was born out of a genuine need for streamlined, user-friendly payroll solutions - today it empowers small businesses across Canada to save time, stay compliant, and focus on what matters most, your business.

Thank you so very much! The easiest program I have ever used in my 30 years of doing payroll. I will highly recommend your Paycub! Creating and sending paystubs is a breeze.

I was so relieved to find your free paystub generator! I started a free trial with reservations, but to my surprise, your site actually did what I needed it to do, which was just create paystubs and keep track of what the employees were earning. Pretty much all of those sites I tried before all want you to process payroll through them or some other gimmick, which I don’t need. I pay out staff through our bank via direct deposit and that works for me.

We just cancelled our contract with Quickbooks Payroll to move over to Paycub – it offers everything we need.

Hi Paycub, Love your website, it saved my life... So easy and friendly to use.

PayCub has taken the stress out of running payroll. What used to take me half a day now takes just minutes, and I know the deductions are right every time.

As a small business owner, payroll was always confusing and time-consuming. PayCub made it simple, accurate, and CRA-compliant without me needing to be an expert.

We've processed payroll through PayCub for over 3 years. It's reliable, easy to use, and gives me peace of mind.

Try Our New Paystub Editor

We make Canadian payroll simple — automatically calculate deductions, stay compliant with CRA rules, and generate accurate pay stubs with ease. With the simple paystub editor, you can add income, calculate deductions (or enter your own), accrue or pay out vacation, and more. From managing employee records to customizing paystub designs, PayCub gives small businesses the tools to run payroll quickly, confidently, and without the stress.

Want to know more about our online payroll software?

PayCub makes Canadian payroll simple — automatically calculate deductions, stay compliant with CRA rules, and generate accurate pay stubs and year-end slips with ease. From managing employee records to customizing paystub designs, PayCub gives small businesses the tools to run payroll quickly, confidently, and without the stress.

Can I try PayCub before subscribing?

Yes! We offer a free trial so you can set up payroll, run test stubs, and explore the features before committing. No credit card required to start.

Does PayCub handle CRA deductions automatically?

Absolutely. PayCub calculates federal and provincial tax, CPP, EI, and employer contributions in real time. Updates are automatic when CRA rates change.

Can I access PayCub on different devices?

-

Yes — PayCub is 100% cloud-based. Access your payroll securely from your desktop, tablet, or mobile device.

-

All your data is synced in real time, so you and your team always see the most up-to-date information.

Do you provide T4 and year-end slips?

Yes. PayCub automatically prepares T4s and summaries for your employees at year end, ready to file with the CRA and distribute digitally or by print.

Can I customize my employees' paystubs?

Yes! PayCub lets you choose from multiple paystub templates and colour options so you can match your brand and give employees a professional, polished look.

What if I need help with my account?

-

Our support team is here to help with setup, running payroll, or troubleshooting issues.

-

You can also access our growing library of guides and FAQs for step-by-step instructions.